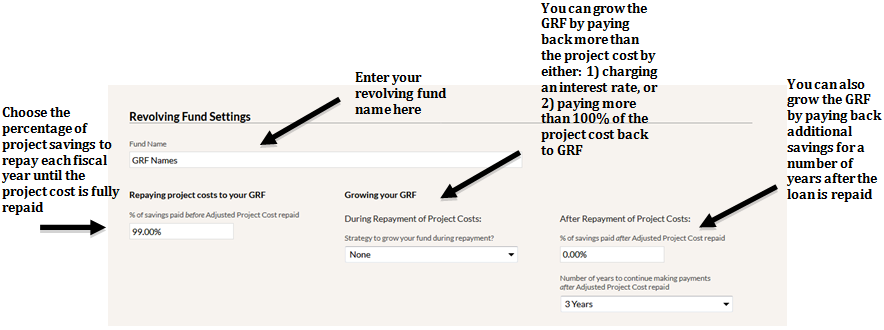

In this section, enter information about your GRF’s structure. These settings vary from institution to institution and govern how calculations in GRITS are made.

- Fund Name: This is your official GRF name.

Repaying project costs to your GRF

- Percent of savings paid before Adjusted Project Cost repaid – This is the percentage of savings from projects generated each repayment period that your institution plans to reallocate to the GRF. GRITS will use this percentage as a guideline (this amount isn’t automatically counted as a transaction; see NOTE below), displaying the amount that you should pay back each fiscal year in the Annual Tracking Data table on each Project Detail

- Most institutions repay project savings in installments on an annual basis, but your payment periods can be adjusted to fit the accounting timeline at your institution (e.g. quarterly, biannually).

- Most institutions pay back 100 percent of savings into the fund. However, an institution can pay back less than 100 percent of savings each repayment period, if desired. For example, an institution can pay 80 percent of savings back each repayment period. That means if they estimated $50,000 worth of annual savings for a project, they would only pay back $40,000 to the GRF each year.

- For participants in The Billion Dollar Green Challenge, SEI requires projects to pay back at least 50 percent of annual savings to the GRF until the project is repaid in full.

- The lower the percentage, the longer time it will take the project cost to be repaid back to the GRF.

*NOTE: Please note that this percentage of savings isn’t automatically added to your GRF’s account balance in GRITS—you must manually enter a Project Loan Repayment transaction on each Project Detail page to indicate when project savings have actually been repaid. This also allows you to indicate that a different size repayment was made than the guideline set up here.

Growing your GRF

Here you can set up strategies to repay extra savings and grow the green revolving fund over time. GRITS will use these strategies as a guideline (the extra amount of savings to repay isn’t automatically counted as a transaction; see NOTE below), displaying the adjusted (extra) amount that you should pay back each fiscal year in the Annual Tracking Data table on each Project Detail page.

During repayment of project costs

There are two ways that an institution can make their Adjusted Project Cost (i.e. loan amount being paid back to GRF) larger than the original project cost. You can either 1) charge an interest, which will accrue annually on the outstanding loan amount, or 2) pay back more than 100% of the original project cost (referred to here as an “admin fee”). Choose one strategy or both from this dropdown menu, or select “None” if your institution is not growing the fund with these options.

You can also apply a custom interest rate or admin fee (or both) to individual projects on their Custom Settings sub-tab, overriding what you have selected here on the Settings page.

- Interest rate – Some institutions charge an annual interest rate on the outstanding balance of project loans to increase the size of the GRF or to provide a return to the institution’s endowment or cash reserves if money was invested from either source. If using an interest rate greater than 0%, the annual principal and interest amounts will appear in the Annual Tracking Data table on the Project Detail page.

- Percent of project costs repaid (Admin Fee) – This is the percentage of the project cost (i.e. loan) that will be repaid to the GRF. The default is 100 percent, meaning you would repay the full cost of the project. Participants in the Billion Dollar Green Challenge must revolve at least 100 percent of the project cost back to the GRF, so that the fund stays the same size and does not decrease over time. Institutions can set this percentage greater than 100 percent as a means to grow the fund. For example, you can repay 120 percent of each project back to the GRF. If the project cost was $50,000, you would end up paying back $60,000 to the GRF in savings (the Adjusted Project Cost).

- Interest rate with percent of project costs repaid – Utilize both an interest rate and an admin fee simultaneously.

*NOTE: Please note that the amount calculated through these options isn’t automatically added to your GRF’s account balance in GRITS—you must manually enter a Project Loan Repayment transaction on each Project Detail page to indicate when project savings have actually been repaid. This also allows you to indicate that a different size repayment was made than the guideline set up here.

After repayment of project costs

- Percent of savings paid after Adjusted Project Cost repaid – This is used when institutions want to grow their GRF by repaying savings to the GRF after the principal loan (i.e. project cost) has been repaid. If you only want to repay the project cost, and not grow the GRF with additional savings, just fill this in with 0 percent. If you wanted to continue to pay back all project savings to the GRF, you would fill in 100 percent. If once you repay the project cost, you want to continue to pay half of the annual savings to the GRF, fill in 50 percent. You can enter in other percentages as well.

- Number of years to continue making payments after Adjusted Project Cost repaid – Many institutions want to repay extra savings to the GRF for only a couple of years after the loan has been repaid. After indicating what percentage to pay after the Adjusted Project Cost has been repaid (see above), indicate the number of years to pay that percentage, or choose “Project Lifetime” if you want to continue to pay that percentage of savings back to the GRF through the end of a project’s lifespan.

- It’s important to keep in mind that there are three ways to organically grow a GRF, as listed above: Interest Rate, Percent of Project Costs Repaid, and Percent of savings paid after Adjusted Project Cost repaid.

*NOTE: Please note that the amount calculated through these options isn’t automatically added to your GRF’s account balance in GRITS—you must manually enter a Project Loan Repayment transaction on each Project Detail page to indicate when project savings have actually been repaid. This also allows you to indicate that a different size repayment was made than the guideline set up here.