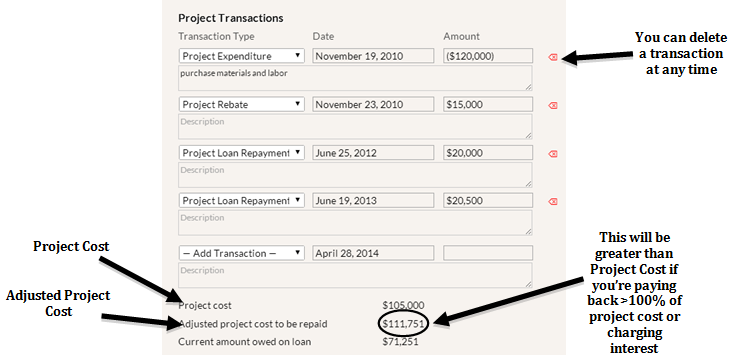

- Project Cost – This is equal to the “Proposed Cost” until a Project Expenditure transaction is entered. Once a “Project Expenditure” transaction is added, it takes that and subtracts any “Rebate” transactions, to determine project cost. If there is only a Proposed Cost and a “Rebate” transaction entered, the project cost will be Proposed Cost minus the rebate.

- Adjusted project cost to be repaid (i.e. Adjusted Project Cost) – This will be a larger number than the Project Cost if you are charging an interest on the loan or if you are repaying more than 100 percent of the project cost (both are indicated on the Settings page or your project’s Custom Settings sub-tab). This is the loan amount that you are paying back to the GRF.

If you are charging an interest rate on the GRF and this project has a smaller annual payback than the annual interest accrual, you will see an infinity sign here. This project will be impossible to pay back while charging annual interest.

- Current amount owed on loan – This is equal to the Adjusted Project Cost (see above) minus any “Project Loan Repayment” transactions. This figure takes into account what you have already paid back in savings to the GRF for this project and shows the amount of money still owed to the GRF.

If you are charging an interest rate on the GRF and this project has a smaller annual payback than the annual interest accrual, you will see an infinity sign here. This project will be impossible to pay back while charging annual interest.